With cranes swinging across big city skylines and brisk business still fueling residential development across the U.S., AEC players and economic observers were heartened last week to see more evidence that this spring’s temporary hiring slowdown was, indeed, the exception and not the rule.

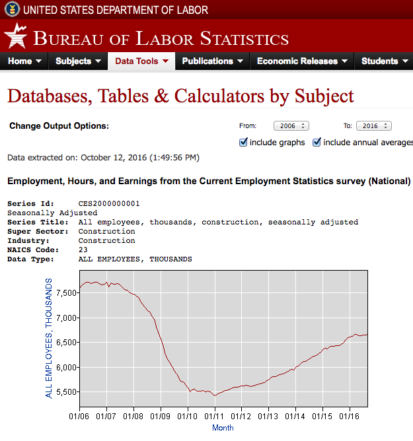

In fact, U.S. construction employers added 23,000 workers in September, enough to push industry totals to 6,669,000, the highest level since December 2008, according to the U.S. Bureau of Labor Statistics. (Coincidentally, that period was also the last time the White House was set to change hands.)

“Demand for construction remains quite strong, but contractors continue to struggle to find qualified workers,” said Ken Simonson, chief economist for the Associated General Contractors of America (AGC). “The monthly declines the industry experienced during the summer were likely caused by worker shortages instead of shortages of work for many firms.”

Such challenges also helped to push the average hourly earnings for construction workers up by 2.8% from their September 2015 level, AGC noted.

“Demand for construction remains quite strong, but contractors continue to struggle to find qualified workers”

While encouraged by this news, others agreed that labor shortages remain significant and could negatively impact future hiring levels, short of greater funding for nationwide career and technical programs. “Just because contractors were able to find people last month doesn’t mean the industry’s labor shortages are over,” said AGC CEO Stephen Sandherr.

An AGC survey of 1,459 contractors released in August found that 69% of respondents were experiencing difficulty filling hourly craft positions. Although, the figure was 10 percentage points below the figure respondents cited in a 2015 AGC survey, they don’t find prospects improving over the next year. Some 38% of respondents reported difficulty hiring salaried field positions; 33% in filling salaried office positions; and 15% in hiring hourly office positions.

“It’s definitely a seller’s market right now, and looks like it will be well into 2017,” added Andy Jansen, CEO at industry job search engine Hard Hat Hub, now a BuiltWorlds company. “Right now, skilled workers pretty much have their pick of where they want to work and for whom.”

“The lack of appropriately skilled labor represents the biggest concern for U.S. construction firms by far… (Yet) chances of near-term recession remain quite low”

“The lack of appropriately skilled labor represents the biggest concern for U.S. construction firms by far,” stated Anirban Basu, chief economist for both Associated Builders and Contractors (ABC) and Procore Technologies. Still, despite other warning signs, Basu is encouraged by the latest job numbers. “All told, [the] data should be viewed favorably,” he said last week. “America’s consumer-led recovery continues to produce enough jobs to sustain itself, and chances of near-term recession remain quite low.”

But recession will return some day, so market watchers like Basu are always scanning the far horizon, looking for early warning signs. For instance, “the American Institute of Architects (AIA) Architectural Billings Index has revealed some nascent weakness in commercial activity,” he noted. “There may be many reasons for this, including seasonal fluctuations. However, there also are data indicating that credit available to commercial real estate is beginning to tighten up. It also remains difficult for many mixed-use developers to line up enough office tenants to allow projects to move forward.”

The current industry unemployment rate stands at 5.2%, according to BLS. Conditions could further tighten if construction activity continues to accelerate. Although U.S. construction underperformed in August, falling 0.7%, activity for the first eight months of the year amounted to $755 billion, 4.9% above the $720 billion the industry logged over the same period in 2015.

Meanwhile, through the first three quarters of 2016, the general labor force has expanded by roughly 2.1 million workers. The last time it had grown that much, that fast, was through the first nine months of the year 2000. As another cautionary note, though, Basu noted that the surge then was employment’s last hurrah before the Dot.com bubble burst in 2001.

Gathering clouds, September stumble?

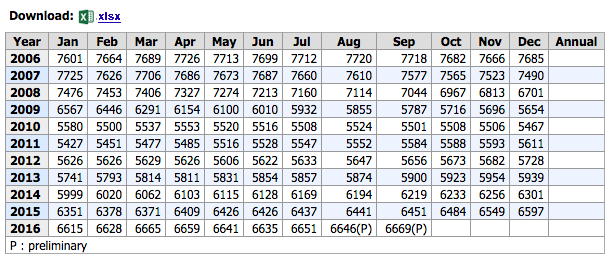

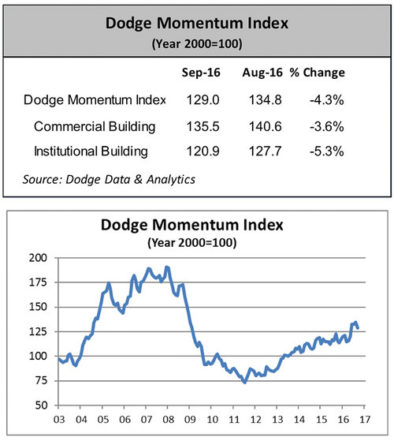

Also seeing clouds on the horizon, Dodge Data & Analytics last week released its latest Dodge Momentum Index (DMI), which fell 4.3% in September from its revised August reading. The index is a monthly measure of the initial report for nonresidential building projects in planning, which can foreshadow construction spending for that market by a full year. According to Dodge, September’s decline resulted from of a 5.3% drop in institutional planning and a 3.6% slide in commercial planning, retreating from the strong performance in August.

Still, the DMI dip follows five consecutive months of gains, and resumes for now “the saw-tooth pattern” that has defined the data since 2014. “Even with the recent volatility on a month-to-month basis, (DMI) continues to trend higher, signaling that developers have moved plans forward despite economic and political uncertainty,” said Dodge in its statement accompanying the new data. “With the September release the Momentum Index is 5.1% higher than one year ago. The institutional component is 5.4% above its September 2015 reading, while the commercial component is up 4.9%.”

Next week, the construction analytics firm will crunch even more numbers to peer further ahead, into 2017 and beyond, when it releases its long-standing annual forecast, the centerpiece of its 78th Annual Dodge Construction Outlook Executive Conference, this year held in National Harbor MD. The event theme is “Disruptive Innovation”, and speakers include Autodesk’s Stacy Scopano — who spoke at BuiltWorlds’ CEO Tech Forum last spring — and Steve Eisman, the former hedge fund manager whose role in predicting the financial crisis of 2008 was portrayed by actor Steve Carell in the 2015 movie The Big Short, based on the best-selling nonfiction book of the same name by author Michael Lewis.

The film, of course, famously ends by asking, “Could it happen again?”

It is a question on many minds this fall as fatigued U.S. voters, consumers, and business owners hunger for the end of the most disruptive and divisive national political season in more than 40 years.

Discussion

Be the first to leave a comment.

You must be a member of the BuiltWorlds community to join the discussion.